Aretha Franklin’s Handwritten Will, Found Under a Couch Cushion, is Valid

by Best Classic Bands Staff

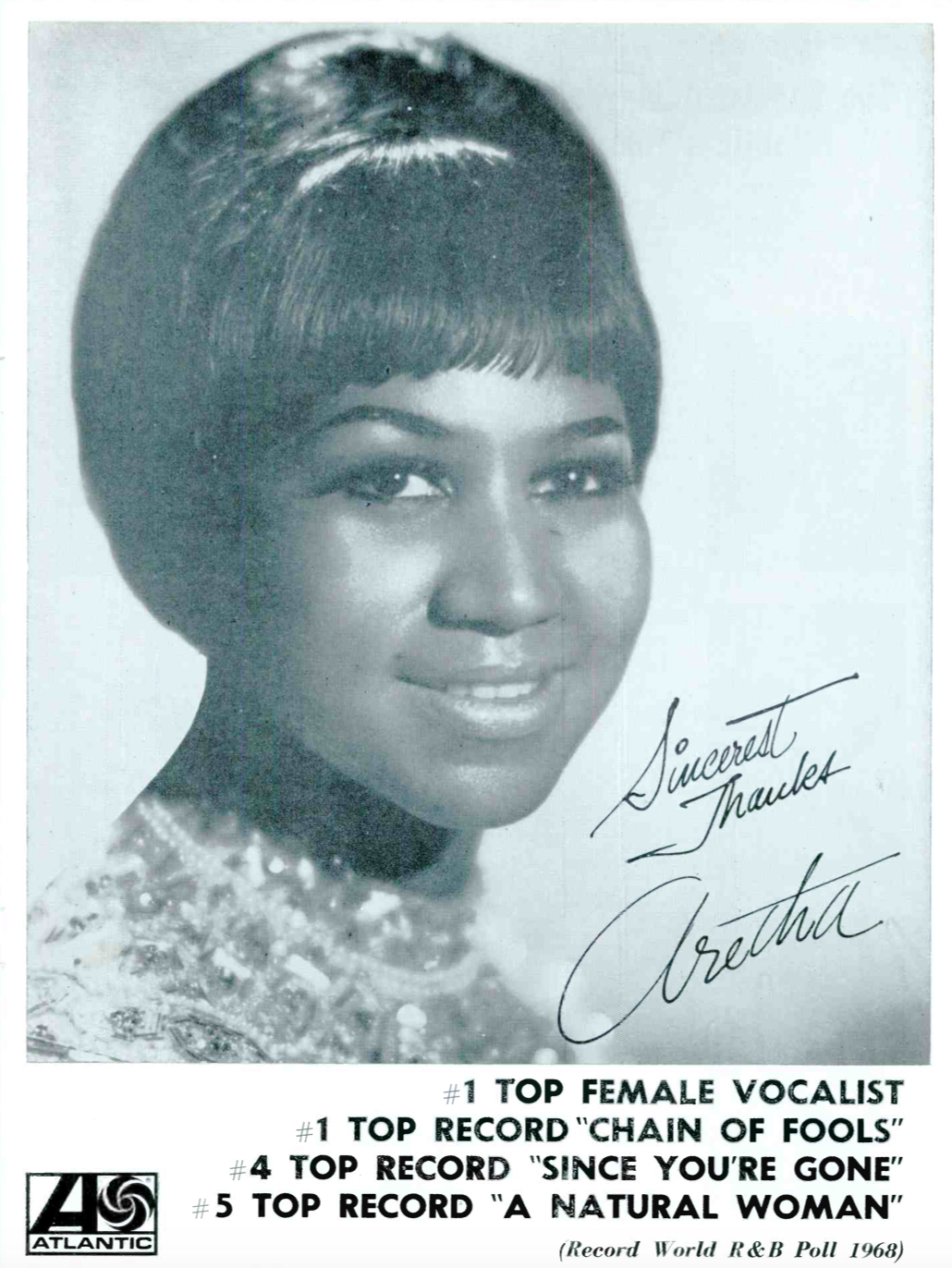

Aretha Franklin via her Facebook page in 2014

When Aretha Franklin died on August 16, 2018, it appeared that she passed without leaving a will. The New York Times reported in its Aug. 23 edition, “According to Michigan law, the assets of an unmarried person who dies without a will are divided equally among their children. Ms. Franklin had been married twice, but was long since divorced.” Her sons — Clarence, Edward and Kecalf Franklin, and Ted White Jr. — listed themselves as “interested parties.”

Months later, no less than three handwritten wills were discovered in her home, one of which the Times described as being “under the couch cushions.”

Today (July 11, 2023), a jury determined that one of those, a 2014 four-page document, was valid. Now the judge must decide how to split Franklin’s estate: her sons had previously, collectively agreed that an 11-page document dating back to 2010 was also valid. Judge Jennifer S. Callaghan will determine whether the more recent will supersedes the earlier one or whether they need to be paired. As the Detroit Free Press wrote in its coverage, Kecalf Franklin “stands to benefit in a big way from the development, including taking sole ownership of her multimillion-dollar Bloomfield Hills home.” He was quoted as saying after the verdict, “We just want to exhale right now. It’s been a long five years for my family and my children.”

The 2014 handwritten will, dated 3/31 and prepared without an attorney, begins “To whom it may concern + being of sound mind…”

The newspaper noted that the two different wills have divided the sons, with Kecalf and Edward supporting the more recent will. Franklin’s signature – “A. Franklin” with a smiley face – appears towards the bottom of the 2014 document. The paper reported that Ted White Jr.’s attorney claimed it was merely a reference to some notes in the text.

The 2014 document noted that Franklin’s music royalties—her largest long-term asset—would be split evenly among those three sons. At the Oakland County Probate Court on July 11, 2023, the six-member jury deliberated for less than an hour to confirm that the will was valid. The Detroit Free Press wrote that her oldest son, Clarence, resides in an assisted living home with an agreement in place for his siblings to support him. Of the relationship of siblings Edward and Kecalf Franklin, and Ted White Jr., the New York Times quoted White after the verdict as saying, “We’re as close as three old men can be.”

This ad for Aretha Franklin appeared in the Aug. 17, 1968 issue of Record World magazine

The singing legend’s estate had previously negotiated with the IRS with what the Detroit Free Press described as a whopping “$7.8 million in unpaid income taxes, interest and penalties” that the Queen of Soul accrued between 2010-2017. The paper reported on March 1, 2021, that the two sides had agreed to a plan to both pay off the tax burden and give the sons some of the income from her estate.

“Since Franklin’s death,” the Free Press writes, “the estate has been steadily paying on the tax debt — and its ever-accruing interest — while formally appealing the agency’s claimed total.”

The arrangement, backdated to Jan. 1, 2021, called for 45% of the singer’s posthumous income “from song royalties, licensing agreements and other money streams” to go to the IRS. 40% would go to an escrow account against taxes on future income. 15%, the paper notes, would be used to manage her estate. Her four sons would each get $50,000 immediately to be followed by quarterly cash payments.

On March 9, 2021, the Free Press reported that the unsigned draft of a fourth will had been discovered, drafted by a Detroit-area law firm in 2018, the year of Franklin’s death. The paper noted that the will was filed in county court by her son, Ted White Jr., who asked that it should reflect her final wishes. White was also a guitarist in her band.

From their fine reporting at that time: According to the filing, Franklin had been working with the Dickinson Wright law firm in Troy since at least 2017 to prepare the will, until she “became too ill to continue to finish discussions on a few items.” The paper described it as a 22-page, typed document, plus a 2017 contract with the firm, signed by Franklin, and handwritten notes from her.

From their fine reporting at that time: According to the filing, Franklin had been working with the Dickinson Wright law firm in Troy since at least 2017 to prepare the will, until she “became too ill to continue to finish discussions on a few items.” The paper described it as a 22-page, typed document, plus a 2017 contract with the firm, signed by Franklin, and handwritten notes from her.

The paper confirmed that most of her assets would be shared equally by sons Edward Franklin, Kecalf Franklin, and White, with a trust set up for her son, Clarence, who has special needs.

The confusion caused by the various wills is said to have caused considerable contention among Franklin’s heirs. Kecalf Franklin had argued that he should be the sole representative for the estate. The Free Press reported that an attorney for Clarence Franklin has argued that Kecalf Franklin has not “displayed any ability or inclination to support himself and lacks the financial knowledge or ability to act as a fiduciary.”

In 2019, the Free Press reported that the Franklin estate earned $1.1 million from the release of the 2019 documentary, Amazing Grace.

A biopic, Respect, starring Jennifer Hudson, was released in August 2021, delayed for a year due to the pandemic.

Related: Tributes poured in following Franklin’s 2018 death

9 Comments so far

Jump into a conversationSo 85% to the government? 15 % to manage the estate ( lawyers & accountants ) and the 4 sons get $200,000…..? So not only does the government rip you off when you’re alive, but in this case, in death too?

This is just so sad. The sons will get quarterly payments? Of what? It seems messed up.

Death and Taxes, Taxes and Death. The Prince estate is STILL in limbo. No will but the company handling it had already received 53 million for lawyers and what not. His family have received a small portion.

All could have been avoided if he’d been responsible enough to set up an irrevocable trust.

Should have paid her taxes like the rest of us. No one likes it but that’s the way it is.

Hmm, Well. I love Aretha and I love her music. The IRS maybe false. She paid something. I praying that this is solved soon.

Respect her sons at least. I owe school loans. Never earned enough to pay baçk. I will pay what I can. Before I die. Sad.

Shortly after her death it was publicized that the attorneys were trying to get payors to reissue numerous royalties checks that she never even cashed. She had money that she never even claimed, according to the report.

Them lawyers, accountants and even her broke ass husband, won’t her money . She is and will always be the legend. And f### the judges and the IRS they just be making up numbers in money. If she owed all this money . How did she go so long and not broke back then. Life and greedy people.

Ever wonder why the accountants never get punished?

Completely irresponsible on her part, and no excuse for her not making a will and paying her taxes. Her son Clarence has disabilities and she should have set up a trust for him, and made arrangements for the rest of her estate. The mayhem after her death could have been avoided.